Appearance

Finance computations

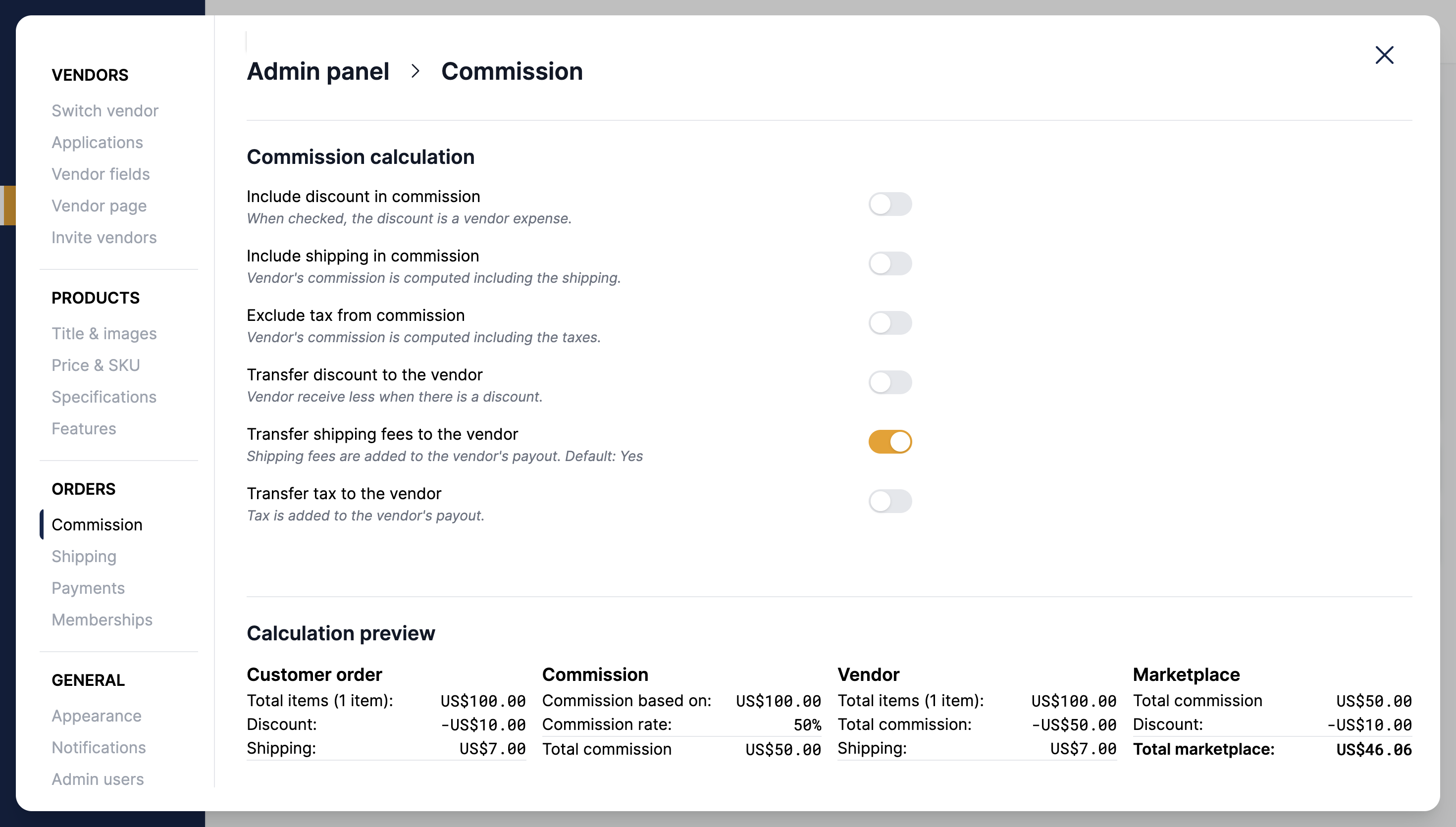

When computing the vendors' payouts, there are several components to consider: the commission, shipping, discounts, and taxes. We will review here the settings

Include in commission

We learned how the commission is computed, these settings define which number the commission is based on. By default, the commission is based on the order price including the taxes.

- Consider including the discount if the discount is a vendor expense.

- Consider including the shipping to incentivise your vendor to have reasonable shipping rates.

- Consider excluding the tax if your local regulation or business model requires the marketplace to do so.

Transfer to vendor

By default, the tax is collected by the marketplace, the shipping to transfered to the vendor, and the discounts are a marketplace expense.

- Consider transferring the discount if the discount is a vendor expense.

- Consider not transferring the shipping if the marketplace fulfills the orders (and not the vendors)

- Consider excluding the tax if your local regulation or business model requires the marketplace to do so.

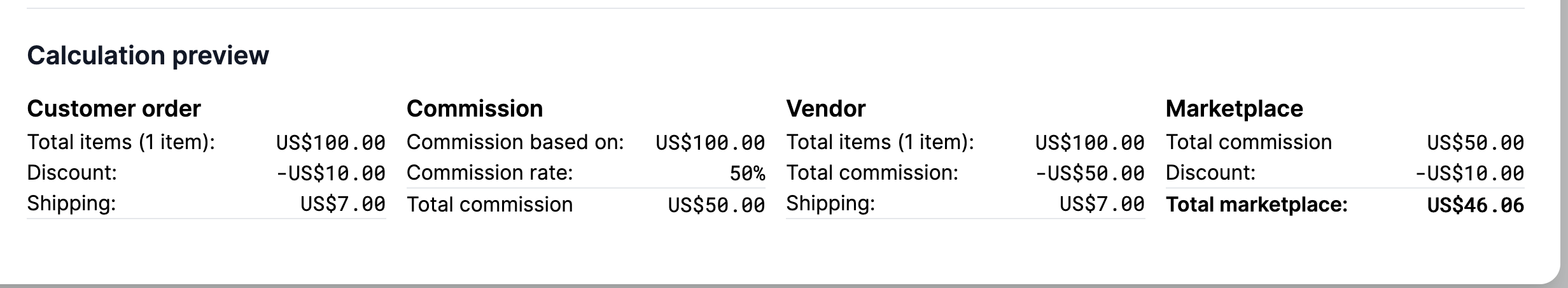

Calculation Preview

To help the marketplace make sense of the computation, Garnet provides a computation preview with a simple order. Note that the tax rate used in the example is for reference only; it will depend on Shopify's calculation based on the customer's location.

Order split

Go to our dedicated section to learn how an order is split between vendors.